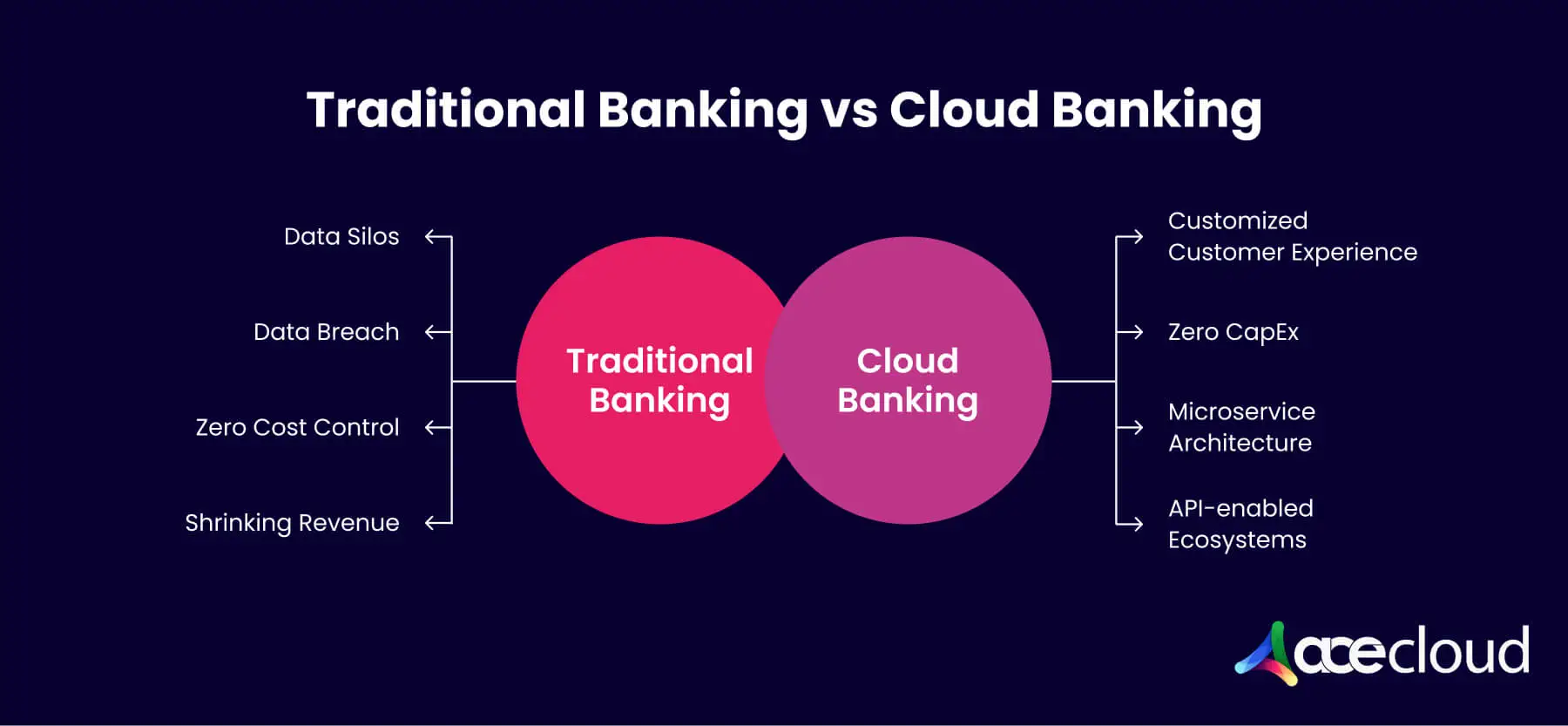

Banking has changed a lot in recent years. From the advent of mobile payments to new methods of making deposits – such as peer-to-peer lending and crowdfunding-and new disruptors such as Bitcoin, the traditional banking model has come under intense pressure.

New technologies have allowed financial competitors to take a slice of the banking pie away from traditional banks and forever change the way we think about finance.

What is the Role of Public Cloud in Banking?

Did you know? In 2023, over 98% of leading enterprises utilized cloud computing to enhance their operational efficiency and streamline critical business processes, up from 91% in 2020.

In Public Cloud, applications are stored on servers rather than personal computers and accessed through the internet instead of local connections.

This revolutionary method of information access has altered business practices in every finance and banking sector, from investment to trading and wealth management.

How Does a Public Cloud Improve Banking Operations?

By replacing outdated physical systems with virtual cloud environments, banks can reduce idle time, lower energy consumption, and improve computing efficiency. Public cloud data centers can handle the same tasks faster and more efficiently than traditional setups, leading to a smaller energy and carbon footprint.

Moreover, cloud technology opens new opportunities for banks, allowing them to innovate and respond quickly to customer needs. By using tools like advanced analytics and machine learning, banks can gain valuable insights into customer preferences, enabling them to provide tailored services. Cloud solutions also make it easier to roll out new applications and features swiftly, ensuring that banks remain competitive in a fast-changing market. This collaborative cloud environment boosts teamwork, fosters creativity, and helps banks adapt and respond to industry trends.

How is Public Cloud Transforming Banking Practices?

The Public Cloud is reshaping the way banks manage risks and operational functionality. It has restructured the foundation of the banking industry and turned traditional desk-side enterprises into web-delivered services, allowing banks to focus on growing their customer base and strengthening their infrastructure.

This transformation is crucial in today’s data-driven economy, helping banks cut costs and adopt a more flexible setup.

Recommended Read: What is Public Cloud – Everything You Need to Know

How Do Banks Benefit from Cloud Computing?

Banks that embrace cloud technology are seeing significant advantages in various areas:

- Deployment – Rapid, convenient, and faster execution of applications from a central data center.

- Operations – Simplified and virtualized practices, more diverse investment opportunities for clients, reduced costs, and increased speed to meet client needs.

- Data Access – Consistent and easy access to data, which improves visibility into customers’ financial status.

- Financial Management – Customers manage multiple bank accounts and credit cards from a single portal, which reduces operational costs.

- Disaster Recovery – Faster automated backup, quicker restoration times, and faster provisioning of resources – all with a lower total cost of ownership (TCO).

- Technologies – Flexibility in utilizing leading-edge mechanisms to meet customers’ requirements and free up existing infrastructure resources, thus reducing costs, mitigating risk, and gaining agility.

- Customer Behavior – Analyzing customer behavior through trends and patterns to create personalized services.

- Global Support – Banks can provide 24/7 assistance to clients worldwide.

- Fraud Detection – Enhanced security measures help detect fraud and protect sensitive data.

How Public Cloud is Transforming the Financial Industry?

Public Cloud presents the following benefits to the IT departments in financial organizations and the technologies they support.

- Enhanced Workload Management

From organizational structure, development, deployment, and maintenance to outsourcing, the cloud’s abilities bring a surge in the performance of FinTech frameworks. By utilizing Public Cloud capabilities, these frameworks respond in nanoseconds and store, analyze, and manage vast amounts of financial data.

They also improve banks’ overall performance by eliminating the distance factor, enabling easier storage of and access to information, saving costs, and helping with better business growth planning.

Financial institutions no longer face greater scrutiny from regulators and can easily solve complex consumer demands with the enhanced speed and scalability of IT systems. - Flexible Cost Management

With traditional systems, you must buy hardware and pay for it yourself. In the cloud, these are variable costs. The moment you need more capacity or power, you simply use a credit card to pay for it.

It starts with a basic plan; from there, you can upgrade as much as you want. Public Cloud allows financial enterprises to harness massive supercomputers without having to build them and relieving them of the enormous capital cost associated with such a solution, i.e., building a supercomputer. - Improved performance

Cloud technology in the banking sector has gained popularity over time. With the rise of cloud services and API-enabled ecosystems, banks can efficiently optimize their resources to deliver customized and personalized customer experiences.

This technology serves as a cost-effective solution for addressing various business management challenges, enabling financial institutions to enhance efficiency through consolidation and flexibility. Additionally, it improves customer experiences, reduces operational costs, and increases overall agility, helping banks quickly adapt to evolving market demands.

Exploring different strategies, such as Hybrid Cloud and Multi-Cloud solutions, can further empower banks to optimize their operations and navigate the complexities of modern banking. - Regulatory compliance

Effective corporate governance and sound risk management enhance financial stability, often achieved through collaboration among market participants and regulators.

A cloud-based platform provides banks with an environment in which they can access these services from anywhere in the world via connectivity offered by the internet.

The cloud facilitates compliance with technical standards required by financial regulators, assuring banks that they maintain a level playing field for competition between banking institutions. - Modernized Data Centers

An outdated data center environment is no match for modern-day cloud services. Public Clouds provide a predictable and consistent infrastructure that can be easily scaled according to your business’s requirements for processing transactions, creating databases, and troubleshooting issues efficiently.

The rapid time frame helps banks respond more quickly by delivering a better customer experience. Public Cloud providers provide dynamic scaling as the business requires at any time, whereas traditional data center management often limits business growth driven by resource allocation issues. - Strong Security Controls

Banking is changing rapidly. The financial services industry is seeing an increasing number of users and customers using fintech applications like electronic payments and mobile banking instead of traditional banking methods.

With this expansion, however, comes an incredibly complex array of threats and vulnerabilities. Financial institutions can implement cloud security controls to ensure that sensitive customer data receives the highest levels of protection possible.

By leveraging Public Cloud providers and platforms, banks can meet their desire for efficient and resilient infrastructure while maintaining the highest levels of network security. They can utilize the latest in cloud firewalls, cloud backup, and other networking tools and techniques.

Begin Your Cloud Journey Today with AceCloud

As the banking industry evolves, traditional institutions must adapt to stay competitive. AceCloud offers innovative public cloud solutions designed to help banks streamline operations and enhance customer experiences. Our flexible pay-as-you-go model allows you to focus on your core business while we handle all hardware configurations.

By leveraging the power of the cloud, banks can improve efficiency, reduce costs, and quickly respond to changing customer needs. With advanced analytics and machine learning, you can gain insights that lead to personalized services and better decision-making.

Don’t let your bank fall behind in this digital age. Connect with AceCloud today for a free consultation and discover how we can transform your banking experience!